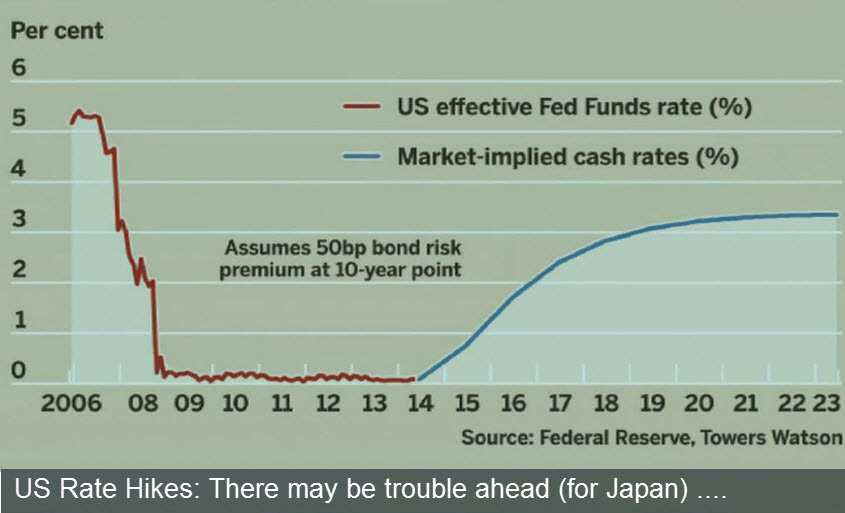

Who will buy Japanese Government Bonds after 2016?

Japan cannot grow its national debt as a percentage of GDP indefinitely. At some point, if government deficit spending remains on its current path, the market will decide the debt cannot be repaid and will stop further buying. When and what might cause that to happen?

Former Goldman Sachs senior economist Takuji Okubo knows the future can never be foreto…